24+ Housing ratio calculator

How long will I live in this home. Get your credit report.

2

Jan 24 2022 Last Updated.

. Use this calculator to better understand how much you can afford to pay for a house and what the monthly payment will be with a VA Home Loan. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The debt-to-income ratio is one.

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. Check out Moneys debt-to-Income ratio calculator. DTI ratio reflects the relationship between your gross monthly income and major monthly debts.

If the income and credit score of the borrower is adequate then the banks may allow the maximum LTV ratio of 90 while considering the loan amount. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. The effective depth-to-span ratio is considered to be between 16 and 18.

The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. Debt-To-Income Ratio - DTI. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender.

Listed below are US housing markets with moderate price to rent ratios from 16 to 20. Calculate the ratio of this difference to the former CPI. 1870 houses sold in August down 41 from last year.

SHARE Debt-to-income DTI ratio compares how much you earn to your total monthly debt payments. Housing debt totals 981 trillion or 7078 of the total. To convert the purchasing power of the US.

Explore homebuyer and rental guides use mortgage calculators renovation and maintenance tips. An effective depth-to-span ratio of 15 to 16 is recommended for pitched trusses with a minimum of 17 unless special emphasis is given to deflection. Jul 15 2022 12 min read.

See comparison of indicators for residential property investment like apartment price to income ratio price to rent ratio gross rental yield loan affrodability index. Check out our list of price to rent ratio by city in 2022 to see the best locations to put your money. There is also an adjusted version of CPI called CPIH that includes housing costs such as.

Banks usually allows LTV ratio up to 90 of the value of property. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. The front-end-DTI ratio also called the housing ratio.

So if you are going to apply for a housing loan to finance a P1000000 housing in a key location in Manila you are eligible for a loan amounting to P800000 meaning youll have to put up the remaining P200000 yourself as a down payment. Secondary mortgages represented 1456 of new loans 495 of new mortgage debt. Representatives Available 247 to Better Serve Troops Overseas 1-800-884-5560 Get a Quote A VA.

Dollar in different years. Applying for a home loan at a fixed rate of interest is better when the current home loan rate of interest is quite low and an upward trend. Onwards for tenures of up to 30 years.

With a radius equal to the span the ratio will be somewhat higher than the recommended minimum. At the same time the benchmark price of homes in Metro Vancouver was 1180500 in August 2022 a 74 annual increase and an increase of 24 in two years. 2021 2022 Mortgage Housing Market Predictions Mortgage Rates.

In the European Union. Get the info you need. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

The Inflation Calculator utilizes historical Consumer Price Index CPI data from the US. Depending on the interest rate a home loan is of three types fixed-rate floating rate and hybrid. LTV ratio is the ratio of loan amount to the value of the property for which loan is planned.

It also offers home loan balance transfertakeover facility to existing home loan borrowers of other lenders at lower interest rates and Griha Varishtha home loan to applicants having pension benefits with loan tenures of up to 80 years of their age. According to HMDA first mortgages represented 8544 of originated home loans 9505 of all new mortgage debt originated in 2018. If your housing-related monthly debts are below 28 you may qualify for a larger loan amount than originally expected.

It is also 67 lower than the all-time high of 1264700 in April 2022. LIC Housing Finance Limited LICHFL offers home loans starting from 800 pa. 2836 are historical mortgage industry standers which are.

Mortgage rates promotional rates. The longer term will provide a more affordable monthly. Fixed Rate Loans Fixed interest rate remains the same throughout the loan period thereby keeping the home loan EMI constant.

US Cities with Moderate Price to Rent Ratio 2022. Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022. Let NerdWallets debt-to-income ratio calculator do the math for you.

Apartment Loans Up To 85 Ltv Low 5 35 Year Fixed Rates

April 2022 City Observatory

Investordaypresentation

Apartment Loans Up To 85 Ltv Low 5 35 Year Fixed Rates

Investordaypresentation

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

2

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage First Time Home Buyers Mortgage Tips

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

2

How To Get Out Of Debt Pay Off Debt Or Save Advance America

California Bearing Ratio Cbr Test Engineering Infinity Facebook

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

2

2

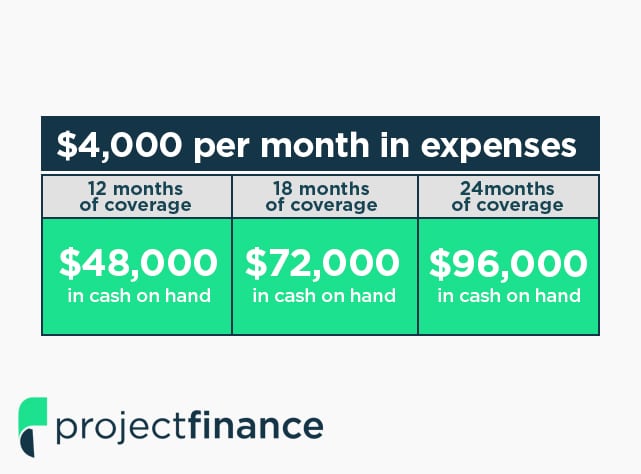

Faq How Much Cash Should Retirees Keep On Hand